Written By Souki Fournier | March 21, 2022 | 4 minute read

You’re familiar with real estate taxes as a homeowner, but have you heard of property taxes? There’s a good chance you have, and you probably use these terms interchangeably, but they’re actually two different types of taxes.

If you’re not sure what the difference is, then keep reading.

We’re explaining what real estate and property taxes are so you can better understand your annual expenses.

Real estate taxes get paid to your local and state governments. They’re based on the assessed value and the values of your city. If you’ve ever heard homeowners complain about how high the real estate taxes are in their area, this is why.

Bigger cities like San Francisco or Manhattan will come with higher tax rates than a house in a rural area. A comparable home in a smaller city will have lower real estate taxes simply because of the location.

They’re determined by multiplying the fair market value of a house with the predetermined value of your municipality. The product of this is called the tax assessment value.

For example, if your home has a value of $400,000 and the predetermined value of your city is 60%, the tax assessment value would be $240,000, or 400,000 x 60%. This is how your tax rate is determined.

So if the rate of your city or county is 5%, then the real estate tax you owe would be $12,000.

Usually, real estate taxes get included in your mortgage payment, but statements go out once a year, in January. If they’re not included in your home loan, you can make direct payments to your city or state government. Generally, you have to pay them in one lump sum, but some municipalities allow you to pay in installments.

Property taxes, also known as personal property tax, applies to, you guessed it, private property. These are items that are moveable and not permanent. This applies to several things, from boats and RVs to business-related items like furniture and machinery.

A perfect example that many people are familiar with is their car. When you register your vehicle, you’re paying personal property taxes.

Personal property taxes are determined similarly to real estate taxes. They’re based on the value of the item and the property tax rate of your city or state.

The most apparent difference is that property taxes get applied to moveable items, and real estate is specifically for real estate. But there are other differentiating factors.

The tax rate is different, and real estate taxes are a lot higher than property taxes. That’s because the value of a house is significantly higher than a car or boat. Even a small home in a rural area will cost at least a few hundred dollars more in taxes than a car, which is often less than $100.

The second big difference is that you can deduct real estate taxes on your federal tax return through a Schedule A. Property taxes can also be deducted on your tax return, but they’ll be a lot less, and you would input them in a different section.

What makes these two types of taxes similar is that they’re both paid locally to city or state governments. Both taxes are also used to fund local public services like schools, infrastructure, and health care.

When purchasing a home or any other personal property, you know that taxes are part of the deal. But what if you’ve inherited a house from a loved one or any of their belongings?

Inheriting a home doesn’t mean you have to pay taxes right away, and the IRS will place a new fair market value on the property. Your tax rate will change year by year as the value of the home changes on a step-up basis. If you decide to keep the house, you will have to pay capital gains tax and real estate taxes.

If your state has an inheritance tax, you must pay it. Even if your state doesn’t tax heirs, you might still have to pay.

Once ownership of any assets officially transfers to you, you’ll be responsible for future personal property taxes, like if you inherited a car or a boat.

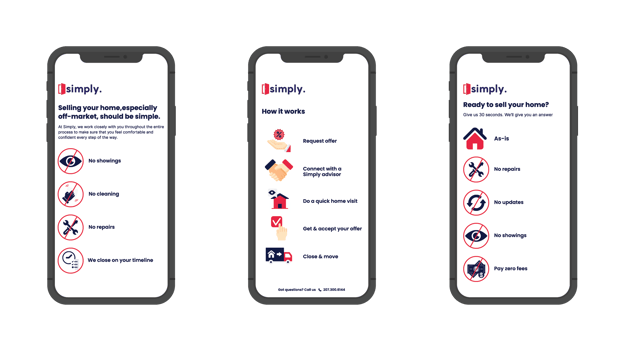

If you’ve inherited a home from a loved one or your real estate taxes have recently gone up, Simply can help. We make cash offers on homes based on fair market value. Our process is quick and easy, and it takes less than a minute to get your unique offer.

So get started now, and see how much you can get for your home.