Written By Souki Fournier | February 1, 2022 | 2 minute read

The tax implications of inheriting a house can confuse anyone. Whether you plan on making your inheritance a home to live in or you decide to sell it, you need to see the overall tax picture.

A smart approach is to ask some key questions as soon as you get access to the property or receive the inheritance check from your loved one's estate. Here are three of the most important tax questions you need to ask when inheriting a house.

If you’ve never inherited a property before then you might be wondering what an estate tax is.

An estate tax is a tax paid on the property before you can receive it. These taxes can vary from each state, so you can’t really know for sure until you consult a licensed tax professional. The good news is, you don’t have to pay this tax directly. However, it will come out of the inherited estate.

The inheritance tax is different from the estate tax, it is based on the property or items that you inherit. The actual tax amount will vary depending on the state, and it is calculated based on the value of the property.

Whether or not you have to pay the inheritance tax depends on your relationship with the deceased. Usually, spouses and dependents are exempt from paying this tax. If your inheritance comes from someone you’re not related to, you will have to pay it.

This might seem like an obvious question but people do forget about it at times. The house you inherited may not be fully paid off, in this case you need to ask if there is a mortgage and whether or not there are enough funds to cover the mortgage.If there is indeed a mortgage, you can potentially take it on if you wish to keep the property. However, if there is a lot of money owed on the property, the smart choice would be to sell it and get out of an expensive mortgage.

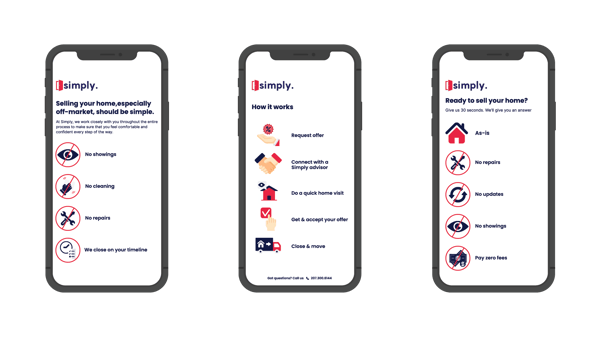

If you decide that maintaining the property will be too much of a financial strain, the best option is to sell it immediately. The fastest way to do that is to sell to a property investor like Simply. We deal with inherited property cases constantly and would love the opportunity to point you in the right direction.

Take the first step today! You could receive your free, no-obligation offer online within 30 seconds. All you have to do is enter your address, and we will let you know if we are interested in your property. After losing a loved one, we know you are facing times, but you can count on Simply to be with you every step of the way.