Written By Souki Fournier | March 15, 2022 | 4 minute read

Inheriting property isn’t as simple as taking over the ownership of a house. Depending on the overall estate, it can turn into a lengthy process and cost thousands of dollars. One potential tax is called capital gains taxes. So what is it, and how do you know if you’ll owe?

Keep reading to learn everything you need to know about capital gains taxes for inherited property.

Capital gains are taxes that are due when you sell an inherited property. However, they are only applied if the home appreciates. There are also a couple of other taxes applied to inherited assets.

Learn more about each one below.

There are three types of taxes for inherited property or assets. Some taxes always need to be paid, while some vary state to state or by the situation.

The heir pays these taxes for the property they inherited. They are based on the overall value of the estate. But it’s essential to know the laws for inheritance taxes vary by state, and there are no federal inheritance taxes.

For these reasons, it’s best to work with an estate attorney and learn your state’s specific guidelines to know if you’ll owe inheritance taxes.

Estate taxes are paid through the estate before anyone inherits it. The minimum threshold is $11.7 million for this tax year. Any additional value is taxed. If your loved one’s estate is valued at $11,750,000, the government will only tax $50,000.

These taxes are paid on the appreciated value of the property an heir inherits. So if you decide to keep the home you inherited, you will eventually be taxed on the value it’s gained, not the house’s value at the time of inheritance.

The IRS calculates the capital gains taxes for inherited assets through a stepped-up basis. When you first take over the property, the value is reset to start on the exact day of inheritance. The longer you own the house, and it increases in value, the capital gains taxes will increase year by year.

This system is in place to help heirs avoid overpaying capital gains taxes. It also means that you may not have to pay these taxes at all. You won't owe capital gains taxes if you inherit a home and immediately sell it.

Your first option would be to sell the property immediately. Doing this would allow you to avoid capital gains taxes altogether because you’re not allowing the home to increase in value.

However, immediately selling a property isn’t always possible. Depending on the age and condition of the house, you may need to make repairs and renovations — costing you more time and money.

If you’ve inherited a home, you can always move in. Doing so would allow you to make updates and take care of the home while it appreciates. When you’re ready, you can sell it at a higher price.

Going this route will require you to pay capital gains taxes on the total dollar amount of the increased value. So if the house is valued at $100,000 at the time you inherited it and it’s valued at $300,000 by the time you sell, you would pay taxes on $200,000 once you sell.

Just because you inherited property doesn’t mean you have to move in. You can choose to keep the property and sell it once the value increases. You can use the home as a rental property during this time or leave it unoccupied for renovations.

But this option could come with a whole other set of stressors like managing tenants and spending money on repairs.

If you want to avoid capital gains taxes in the future, the best option is to sell the property right away. But this is easier said than done. If the home is old or in need of repairs, the entire process could end up costing you even more than the extra taxes.

Even if the home is in excellent condition, working with a real estate agent takes time and comes with fees too. So what can you do?

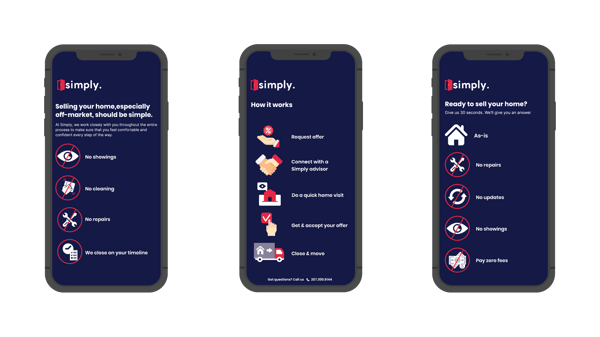

Sell to Simply.

We’re experts in selling inherited properties fast, and we’ll make a cash offer based on your home's current market value — no repairs or fees required. Best of all, it only takes 30 seconds to receive your offer.

Get yours now!