Written By Brian Bagdasarian | June 2, 2021 | 3 minute read

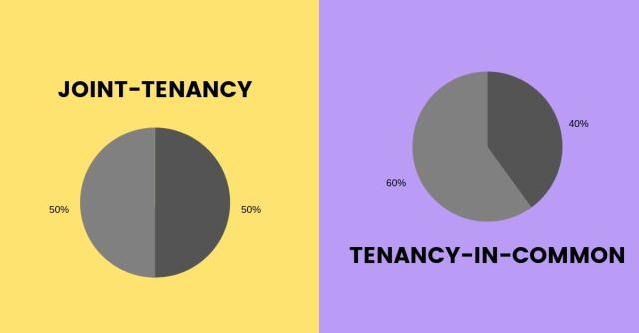

If you own real estate (or “real property”) with another person (or other people), then there are a variety of ways that title may be held by your group. The two most common ways are known as joint tenancy and tenants in common. While both of these ownership types create the situation where you both (or all) are owners, there are a few key differences to be aware of between the two options. Its also important to note that while the term “tenant” is commonly understood to be a person that rents a property, in this case it actually means ownership.

It’s important to know that the order in which the names are listed on a deed have no impact on ownership or rights. It’s just how they were entered into the system!

Joint tenancy is the most common form of ownership for couples (or family) that purchase a home together. Joint tenancy has a few key aspects that make it different from Tenants In Common, which we’ll cover next. They are:

It’s important to note that while joint tenants automatically inherit the share of ownership when one passes away, it is still possible for one person to sell their interest in a property. When that happens, the ownership would change to Tenants In Common.

When property is owned by two or more people as Tenants In Common, it means that they all own a share of a property. A key difference between Joint Tenancy and Tenants In Common is that while joint tenants must own equal shares of a property, Tenants In Common can own differing percentages. For example – let’s say that Joe and Jane decide to buy a home, and they are also going to have an in-law apartment on the property for Jane’s mother Laura. If they all went on title at the same time, and all agreed to own equal shares, then they would be Joint Tenants.

But what if Joe and Jane only wanted Laura to own 20% of the property, and they wanted to own the other 80%? This would be when they would choose to instead hold title as Tenants in Common. This would allow for the different percentage of ownership, and would also allow for Laura to leave her 20% ownership in the property to someone else, like Jane’s sister Jen. When Laura passes away, Jen would inherit the ownership, and be added to title as a Tenant In Common.

There is! If title is held in Joint Tenancy, then estate taxes are delayed on the property. Because the surviving person automatically inherits the deceased person’s interest in the home, no estate tax is owed. When the surviving person passes away, and their heirs inherit the house, then estate taxes would be due.

If someone who isn’t a spouse is added to title as a Joint Tenant, then gift taxes would be due, as the equity in the property would be considered a gift. This means that gift taxes would apply to the ownership transfer. The takeaway here is that you should always make sure that how you decide to hold real estate is part of your larger estate planning activities. If you are ready to sell a property that you’ve inherited an interest in, we’d love to talk to you! As always – consult a lawyer.